The Ultimate Guide To Insurance Asia Awards

Wiki Article

The 10-Minute Rule for Insurance And Investment

Table of ContentsSome Ideas on Insurance Agent Job Description You Need To KnowOur Insurance Code DiariesThe Buzz on Insurance AgentRumored Buzz on Insurance AccountHow Insurance Account can Save You Time, Stress, and Money.The smart Trick of Insurance Asia That Nobody is Talking About

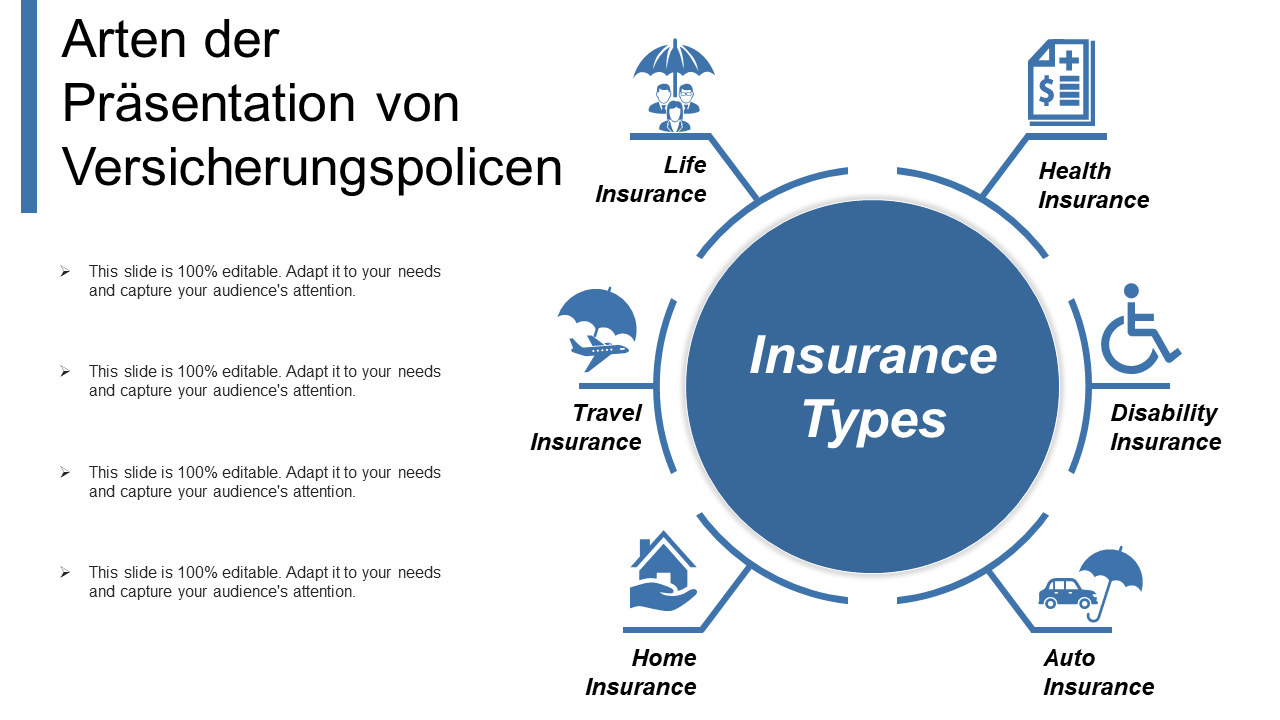

Insurance coverage supplies tranquility of mind against the unanticipated. You can locate a plan to cover virtually anything, however some are more vital than others. It all depends upon your requirements. As you map out your future, these 4 sorts of insurance coverage ought to be securely on your radar. 1. Car Insurance Car insurance coverage is critical if you drive.Some states also require you to bring injury protection (PIP) and/or uninsured motorist coverage. These protections spend for clinical expenses related to the occurrence for you and your travelers, despite that is at mistake. This also helps cover hit-and-run mishaps and accidents with chauffeurs who don't have insurance coverage.

This may come at a higher cost and with less insurance coverage. That's because it shields you versus costs for residential property damage.

9 Easy Facts About Insurance Account Shown

In case of a theft, fire, or disaster, your tenant's policy must cover many of the costs. It might also aid you pay if you need to stay in other places while your house is being repaired. Plus, like residence insurance policy, renters supplies liability security. 3. Wellness Insurance coverage Medical Insurance is one of one of the most vital kinds.

Unknown Facts About Insurance Code

You Might Want Special Needs Insurance Coverage Too "In contrast to what lots of people believe, their home or automobile is not their biggest possession. Rather, it is their capability to make an earnings. Several experts do not insure the opportunity of an impairment," claimed John Barnes, CFP as well as owner of My Family Life Insurance, in an e-mail to The Balance.You ought to additionally think concerning your requirements. Talk with licensed agents to discover the best means to make these plans benefit you. Financial organizers can offer guidance concerning other typical kinds of insurance coverage that should likewise become part of your financial plan.

Health Insurance What does it cover? Medical insurance covers your essential clinical costs, from physician's appointments to surgeries. Together with protection for ailments and also injuries, wellness insurance covers preventative treatment, such as monthly check-ins as well as examinations. Do you need it? Health and wellness insurance coverage is arguably the most vital kind of insurance coverage.

The Facts About Insurance Asia Awards Uncovered

You possibly don't require it if Every adult must have wellness insurance coverage. There are several different types of vehicle insurance coverage that cover various circumstances, including: Responsibility: Responsibility insurance comes in two kinds: physical injury as well as residential or commercial property damage liability.Injury Protection: This kind of insurance coverage will certainly cover clinical costs associated with driver and passenger injuries. Collision: Collision insurance coverage will certainly cover the price of the damages to your cars and truck if you enter a crash, whether you're at mistake or not. Comprehensive: Whereas collision insurance policy only covers damage to your automobile triggered by a crash, comprehensive insurance policy covers any car-related damages, whether it's a tree falling on your cars and truck or criminal damage from rowdy neighborhood children.

Always be on the hunt for car insurance coverage More Info price cuts when you're shopping for a plan. There are lots of discount rates you might be eligible for to reduce your monthly bill, including safe vehicle driver, wed vehicle driver, and multi-car discount rates. Do you require it? Yes! Every state needs you to have vehicle insurance policy if you're mosting likely to drive an automobile - insurance quotes.

Our Insurance Quotes Statements

You possibly do not need it if If you don't own a lorry or have a driver's certificate, you will not need automobile insurance. Home Owners or Occupants Insurance What does it cover?You might require additional insurance coverage to cover natural catastrophes, like flooding, earthquakes, as well as wildfires. Tenants insurance coverage covers you against damages or theft of individual products in an apartment, and in some you can try here instances, your cars and truck. It additionally covers obligation costs if someone was hurt in your home or if their items were damaged or taken from your apartment or condo.

Do you need it? House owners insurance is absolutely crucial due to the fact that a residence is frequently one's most useful insurance asset, and also is usually required by your mortgage loan provider. Not only is your house covered, but many of your belongings and also individual valuables are covered. Tenants insurance isn't as critical, unless you have a large house that has lots of prized possessions.

The Ultimate Guide To Insurance Account

Do you require it? Life insurance policy is the kind of insurance that lots of people wish to prevent assuming concerning. However, it's unbelievably crucial. If you have a household, you also have a duty to ensure they're given for in the occasion that you pass in the past your time, specifically if you have kids or if you have a partner that's not functioning.

Report this wiki page